Explain Different Methods of Calculating Depreciation

Cash comprises currency coins petty cash Petty Cash Petty cash means the small amount that is allocated for the purpose of day to day operations. Read more checking account Checking Account A checking account is a bank account that allows multiple.

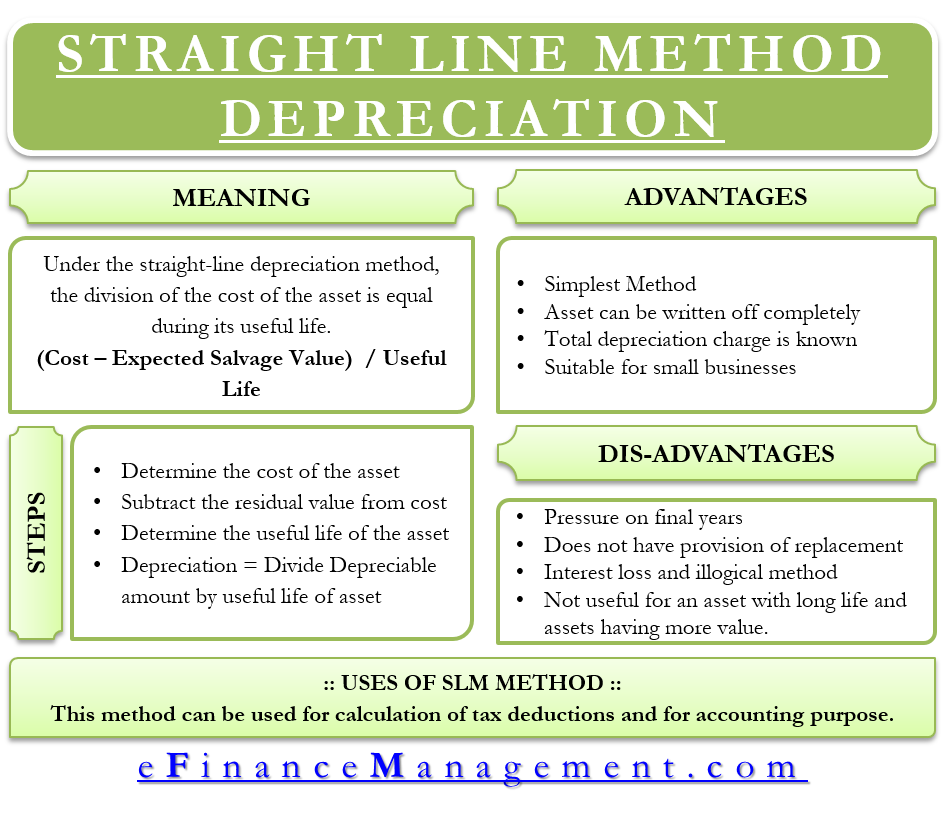

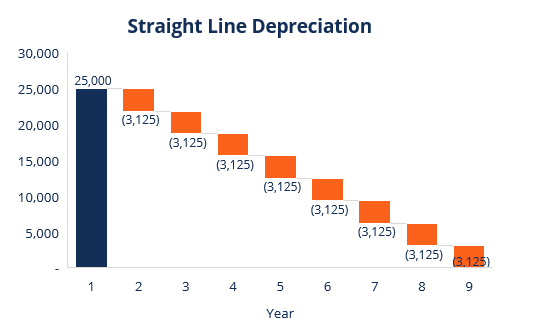

Straight Line Depreciation Efinancemanagement

If the exempt organization and the partnership of which it is a member have different tax years the partnership items that enter into the computation of the organizations UBTI must be based on the income and deductions of the partnership for the partnerships tax year that ends within the organizations tax year.

. It is unreasonable to issue a check for such small expenses and for managing the same custodians are appointed by the company.

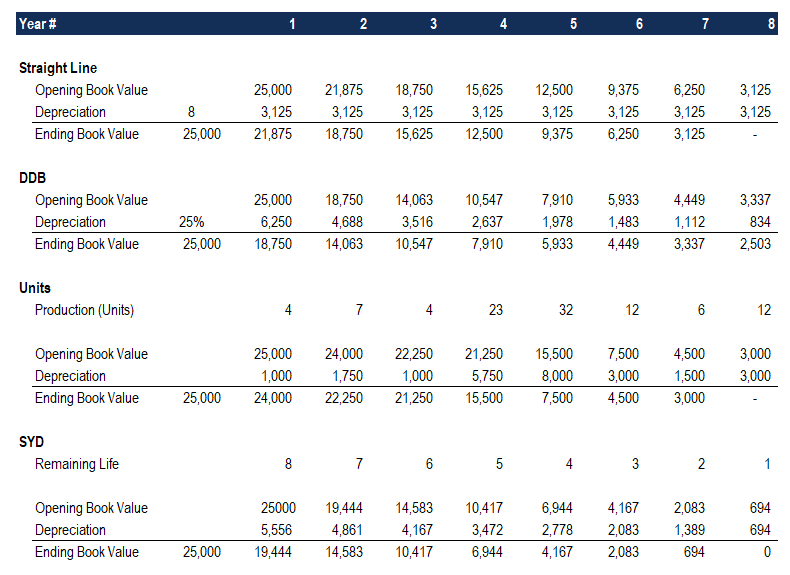

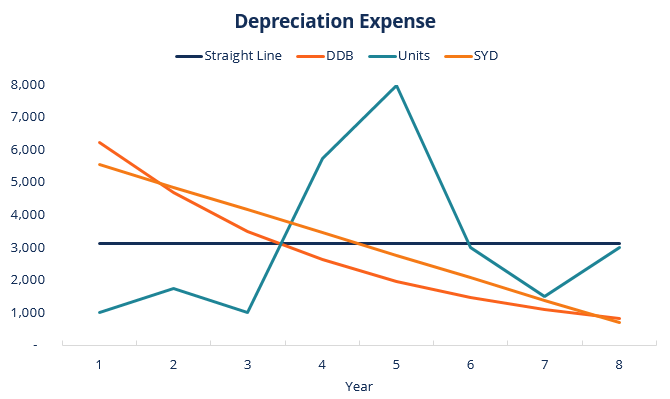

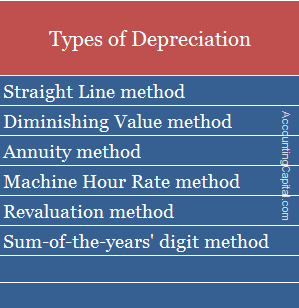

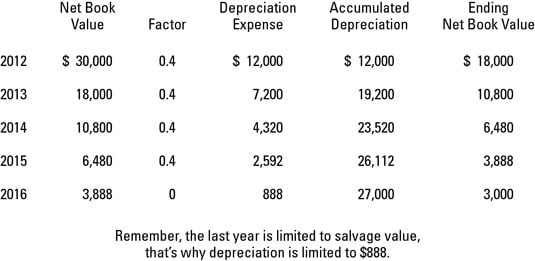

Depreciation Methods 4 Types Of Depreciation You Must Know

Depreciation Methods Check Formula Factors Types Quickbooks

Depreciation Methods 4 Types Of Depreciation You Must Know

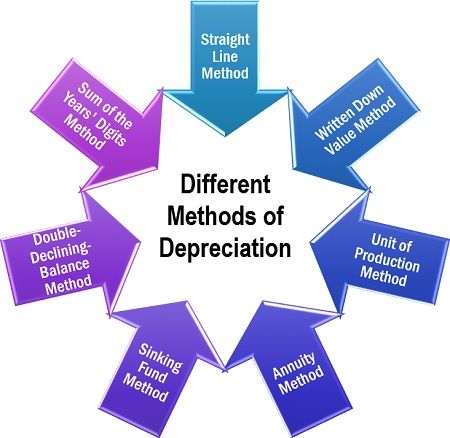

Different Methods Of Depreciation Definition Factors The Investors Book

Depreciation Methods 4 Types Of Depreciation You Must Know

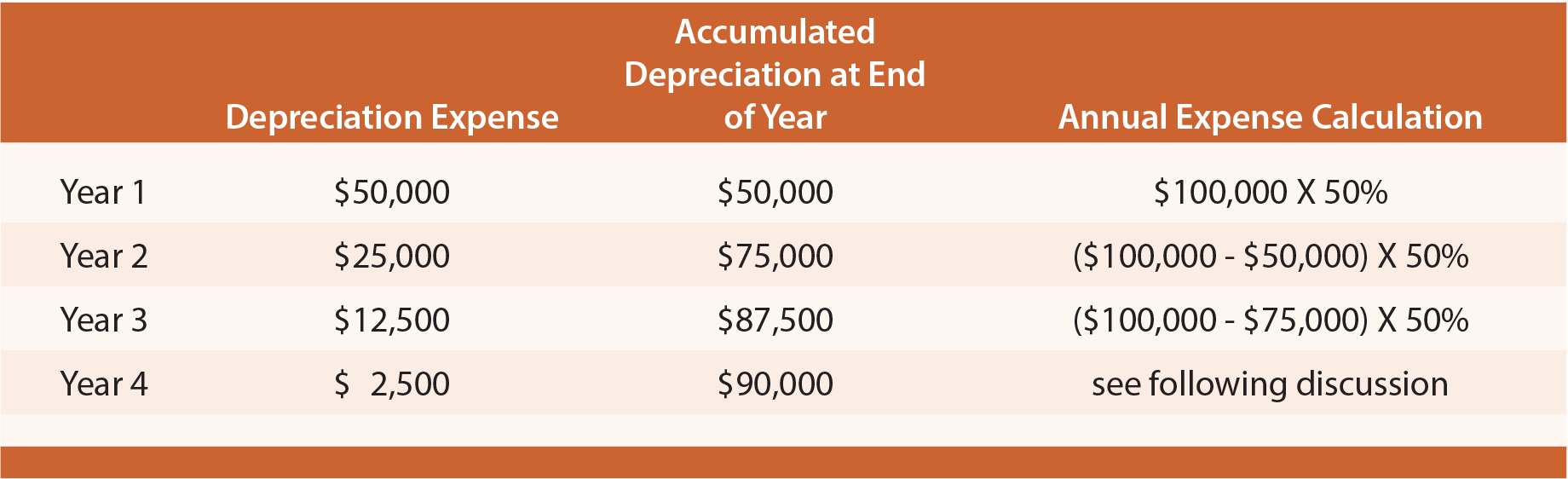

Methods Of Calculating Depreciation Amount Slm Annuity Method Q A

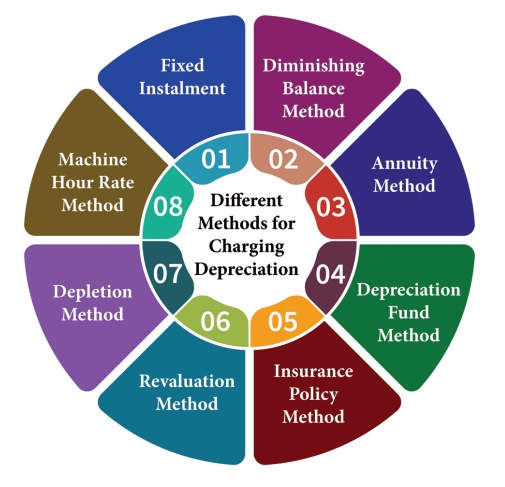

Different Methods Of Charging Depreciation Auditing

Depreciation Methods Principlesofaccounting Com

Depreciation Methods 4 Types Of Depreciation You Must Know

Depreciation Formula Examples With Excel Template

Methods Of Depreciation Learn Accounting Method Accounting And Finance

Depreciation Formula Calculate Depreciation Expense

What Is Depreciation Definition Objectives And Methods Business Jargons

What Is Depreciation Types Examples Quiz Accounting Capital

Depreciation Definition Types Of Its Methods With Impact On Net Income

Methods To Calculate Property Depreciation Building Costing And Estimation Civil Engineering Projects

Comments

Post a Comment